Explore your opportunities

Professionally selected & managed climate funds

Putting capital to work

Enable breakthrough climate solutions

You can become part of the solution by investing in climate tech companies that innovate and build solutions to solve real challenges. If these companies scale, your impact and returns grow with them.

What is a portfolio fund

Portfolio funds are multiple funds in one

A portfolio fund is a collection of several funds. Each underlying fund specializes in specific market segments and/or strategies.

Broad diversification, deep knowledge

Experienced fund managers invest for you

Investing directly in a single company is very high-risk and time-consuming. With fund investing, you allow investment teams to work for you. Their professional investors work diligently to build you a diversified portfolio and subject matter experts support these companies to scale. In the end, you invest across all sectors and lifecycles, reducing risk.

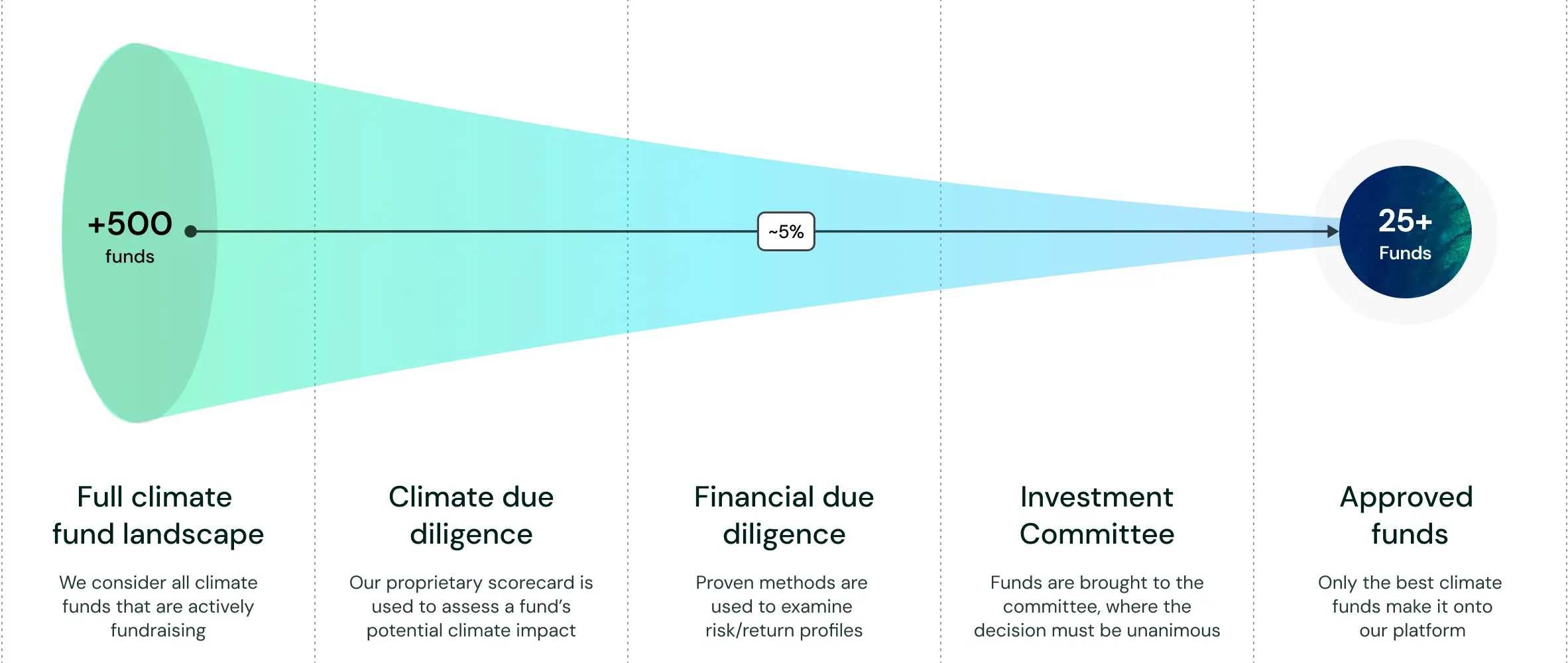

Curating climate portfolio funds

We only select the best climate funds

Our portfolio funds are a curated collection of private equity and venture capital funds. All funds are focused on creating climate impact and attractive returns.

How to get started

Explore your opportunities via our platform

Create an account, view the information about our funds, and compare your options. When you are ready to commit, the investments can be fully completed within the online environment, but our team is here to help if you need us.

.webp)